|

http://ift.tt/2hK2ba8

The battle for consumers gets physical (instead of virtual) http://ift.tt/2DAHM0P Tom Goodwin is EVP, head of innovation at Zenith Media. More posts by this contributor: The world’s largest taxi firm, Uber, is buying cars. The world’s most popular media company, Facebook, now commissions content. The world’s most valuable retailer is now Amazon, and has over 350 stores, And the world’s largest hospitality provider, Airbnb, increasingly owns real estate. Things change. Before, these companies were praised for the genius of building a thin layer of horizontal services on top of massive businesses with fixed assets. They added value to vast audiences with relatively few staff and no assets. What we now see is how they’ve had to build foundations, offer more services, add depth to their offering, these companies have moved from facades to edifices. Thin Interfaces got thick. The extraordinary way that companies could grow rapidly, globally and with little investment, by was with thin layers on top of a complex system of other’s goods or services, that owned the customer interface. We see companies or brands like WeWork, eBay, Instacart, GrubHub, Venmo, or YouTube, as ultra efficient narrow layers, adding value by owing the relationship and data with people. It’s been the fastest, easiest, most risk free way to build a business ever, not least because companies have largely been able to reap the rewards and face few consequences, responsibility has been an externality. Facebook or YouTube (and many other online platforms) get to monetize content with advertising, but recent issues with tonally appropriate content now require their involvement and attention to improving third party metrics and verification. Uber get’s a pass when it’s drivers did something wrong, because it didn’t really employ them. Amazon or Alibaba can become both tax efficient and bypass some regulation, because it’s just a platform. Airbnb when it suits it, is just a host, eBay is a marketplace, Seamless a tech stack if someone gets ill. It’s this rapid expansion which in a market where market capitalization is more closely linked to growth trajectory than revenue (let alone profitability) , which has created some of the most valuable companies the world has ever known. Yet the honeymoon period is over, and to maintain valuations these companies need to earn profit. So these companies have been driven to change, both to defend market position and to add more value and thus be able to earn the income required to maintain such valuations.

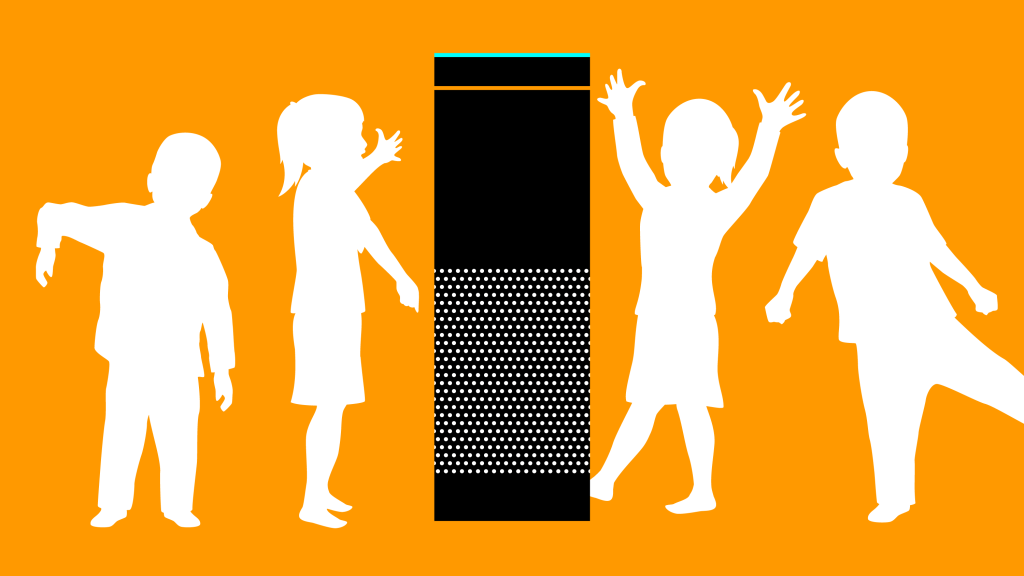

With Uber, it turned out the only thing they liked less than having cars, was having responsibility for it’s employees. In fact paying out 70% of revenue is close enough to financial crippling to mean that some think Uber is intrinsically flawed as a business model unless it can remove drivers altogether. These are dark times for many workers. Uber drivers ( like warehouse workers) are literally creating training data and business model validation, to allow their own replacements to take over. Uber’s horizontal plays like Uber rush, Uber Eats, or expansion to Asia and Africa have not reaped rewards, so we can expect them to become move to develop their own cars, to make self driving features a reality and find other ways to become profitable. They need to shift to being more vertical to make profit. Facebook, like Apple SnapChat, Spotify, YouTube, Netflix and Twitter is busy not just owning distribution, user data and making money from attention, but now taking an active role in making it. For a company that claims not to be a media owner, they now monitor content, help make content, commission content, decide what to promote, and now seek a stronger role in editorial decisions. They just haven’t quite built the function that takes responsibility, but they will do their best to train AI to. Once Facebook could host cheap Upworthy clips , now it increasingly needs to dig deep to buy content and dig deeper to ensure it’s quality checked and brand safe. It’s clear that for every media owner in this digital age securing rights to exclusive and premium content is the battle. It’s an expensive game. Netflix will spend $7 to $8 billion, Amazon nearly $5 billion, Hulu over $2.5 billion, and Apple will spend several billion as well. Amazon also sees that online shopping doesn’t always have great unit economics and isn’t yet a majority of consumer spending. Both Amazon and Alibaba see that owing some physical footprint has merit. They have the tech skills, the cash and the moxie to think that having threatened and decreased the value of retail real estate, they can waltz in and show incumbents how it’s done. There is a wonderful synergy between on and offline elements. Physical retailers need to be able to make money online, which is pretty much impossible given the way they’ve built around the main street. Online stores want to be able to be more profitable, boost their brand name, up sell to customers, do last mile delivery, reduce brutal costs and a footprint allows this. Airbnb needs to grow but where does it go? With very promising growth, wonderful unit, a great brand and a rare profit margin, Airbnb still has a rather large valuation to live up to. It has two choices, does it expand vertically or horizontally. Fortunately it can do either. Horizontal expansion means building on it’s “human” platform. How can it use online marketplaces to sell tours around cities, how can it provide local chefs, maybe it can turn into task rabbit and instal blinds and flatscreen TV’s, or cleaners. It can leverage connecting people to make money in new areas, but the economics aren’t promising. So it’s more likely to build it’s brand in habitat and design. It’s working with developers in unlikely parts of Florida to construct a modern hybrid hotel/home complex. But as yet it’s more franchising it’s brand than something more substantive. For the future I’d bet we’ll see Airbnb as a brand that takes a more active role in construction in the future. It’s insane we live in an age of pre fab buildings, smart homes, 3D printing, and $100,000m of new homes sold per year and no brands have tried to disrupt it. I’d soon expect to see IKEA, Muji, Walmart , WeWork and other large firms make moves into re-imagining home design for today. So as a general rule these companies have matured, they’ve deepened their offering, they’ve constructed more definable positions. Tencent and Alibaba look to spread into banking and commerce and then probably everything. Netflix wants to make more and more and more content.Tesla wants not to make electric cars, but accelerate the planet’s move to sustainable energy. The pace of change is fast, but and the next stage of growth is coming. If you’re a bank or a car maker, a TV company, a retailer or a construction outfit, and for many other sectors, it’s time to ask, where are these companies going next and what can be done to get there first. Featured Image: TechCrunchSocial Media via Twitter – TechCrunch https://techcrunch.com January 25, 2018 at 01:02PM

0 Comments

Leave a Reply. |

�

Amazing WeightLossCategories

All

Archives

November 2020

|

RSS Feed

RSS Feed